In an attempt to bring UAE relations in line with global practices as well as adapt to the ongoing changes in the workplace, the country has started a comprehensive revision of its current legislation and bylaws. One such result is the introduction of Federal Decree Law No. 57 of 2023 (Pension Law), which came into effect on October 2, 2023. The newly introduced pension law holds the most significant changes to the pension landscape of the country while amending Federal Decree Law. No. 7 of 1999 (First Primary Legislation for Pension).

Applicability:

The introduction of the new pension law does not remove the applicability of Law No. 7, 1999 (the old law), save where it has been expressly amended by the 2023 pension law. It stands operative specifically for all the other previously employed Emiratis in the UAE who were registered for the purpose of paying pensions to the General Pension and Social Security Authority (GPSSA). Whereas it is required to note that Federal Decree Law No. 57 is applicable exclusively to Emiratis who are newly hired as of October 2023. Also, with respect to the insured person who has received an end-of-service bonus under Law No. 7, 1999, he will continue to be covered by that only, even if the person starts a new job after the issuance of Law No. 57.

Key Changes Brought by Pension Law 2023:

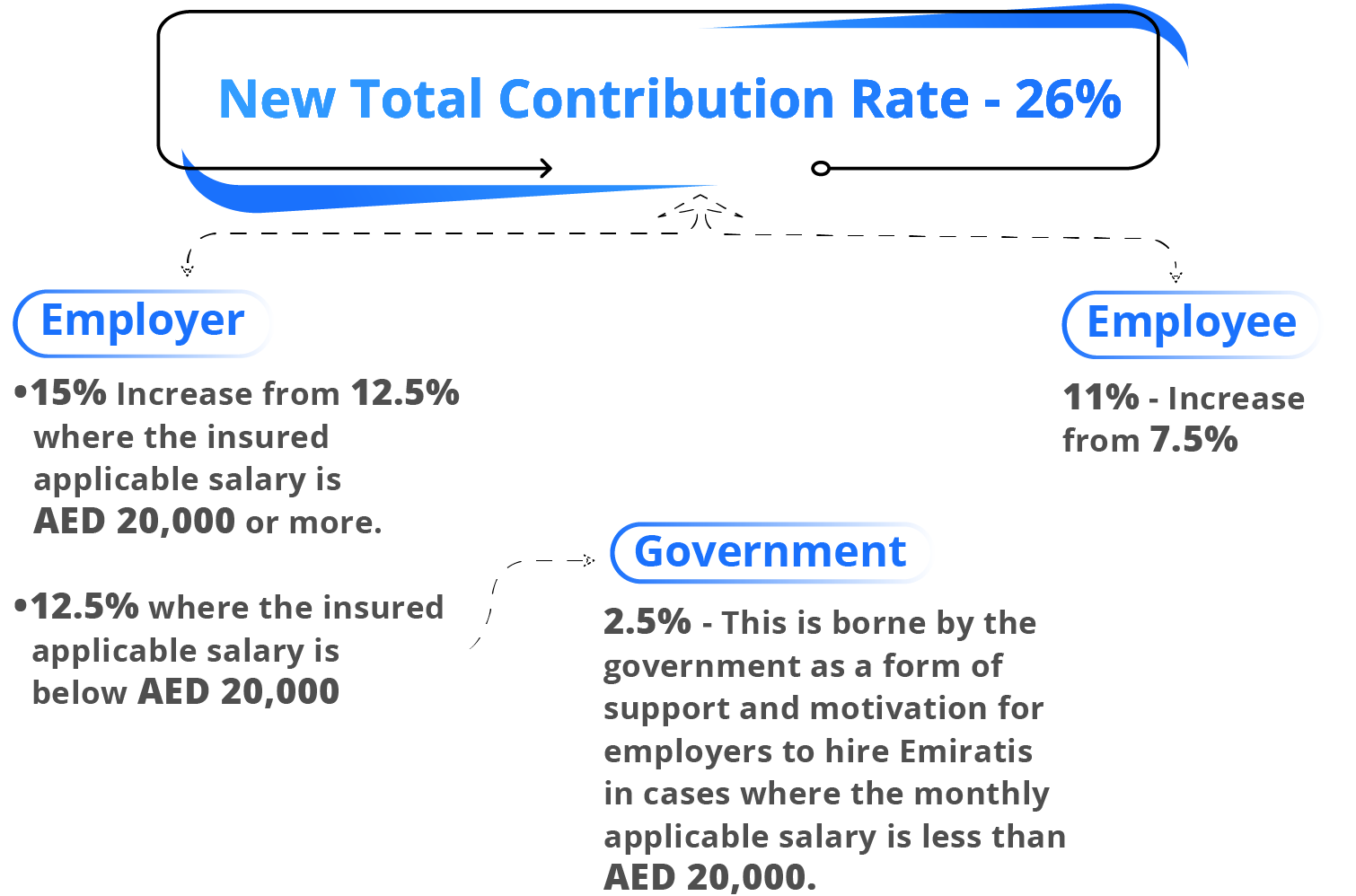

- Monthly Contribution Rates: Contributions must be computed and paid on a monthly basis to the General Pension and Social Security Authority (GPSSA) out of the entire salary of the employee, including incentives, bonuses or commissions. Details of the contribution are below:

- Pensionable Salary Cap: An increase in the maximum salary limit has been made, resulting in AED 10000 for public sector employees and AED 70000 for private sector employees.

- Service Periods: All contributions from employers, employees and the government must be continue to be made during periods of leave as well, even if it is unpaid. The following provision is also applicable to the Emiratis, which are governed by Law. No. 7 of 1999.

- Calculation and Payments of Contributions: For every year of the contribution periods, the pension is computed at a rate of 2.67% of the salary in the pension account. After 30 years, this rate is raised by 4% per year, up to a maximum of 100% of pay.

Employer’s Obligations and Penalties:

- Within a month of starting work, it is required on the part of employers to register their employees with the General Pension & Social Security Authority (GPSSA), and in the event of the end of employment, the update of the same must also be made within 15 calendar days following the end of employment. The law states penalties for employers who fail to comply, including a fine of AED 200 per day in addition to a one-off lump sum fine of up to AED 50,000 per employee.

- It is required on the part of employers to provide statements, lists and documents, including the details of their salary, to the General Pension and Social Security Authority (GPSSA) within 10 days as asked by the Authority. Whereas, in case of delay in furnishing such documents, an additional amount of Dh100 for each such day shall be paid by the employer.

- Employers are required to pay a contribution amount on a monthly basis for each eligible employee until the time his employment ends. The delay in paying the contribution amount will result in the payment of an additional amount of 0.1% of the outstanding contributions for each day of delay and will be charged without warning or notice.

- It is required on the part of employers to make sure that contributions are made accurately out of the employee’s, salary and failure can result in the payment of an additional amount of 10% of the contributions due.

Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as legal advice. The content of this article is not intended to create and receipt of it does not constitute any relationship. Readers should not act upon this information without seeking professional legal counsel.