COMPANY OVERVIEW

Financial service provider supporting their customers for more than 4 decades, through a range of financial services as:

- Retail and wholesale financing solutions and extended protection products to their customers and dealers for the complete line of machinery and engines, solar gas turbines, other related equipment and marine vessels

- Subsidiary of world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives

Registered NBFC

INR 10,624,627,200 Retail Portfolio

2900+ Assets

INR 996,176,880.00 Wholesale Portfolio

CLIENT’S TRANSITION JOURNEY

| CHALLENGES | SOLUTIONS |

|---|---|

| Enhance risk and process management | Risk parameters and tolerance levels have been fixed and standardized as Compliance breaches can lead to severe legal, financial, and reputational consequences |

| Maintain reports and fulfill prudential norms | Management can now create Reports through analytic dashboards, regulatory updates, Compliance Certificate etc. |

| Increase operation efficiency | By analyzing compliance data, our client optimize workflows, reduce inefficiencies, an enhanc overal performance |

| Minimizing improper utilization of client’s data | The ongoing process of tracking and monitoring documents was facilitated by our compliance tool |

| Accurate annual tax documents | Better visibility, transparency and accountability in the system |

| Identification as to the ownership of roles & responsibility | Roles & Responsibility were clearly defined among different department and users |

| Regulation and smooth functioning of organization | Internal Policies and Procedures were created |

HOW LAWRBIT’S COMPREHENSIVE COMPLIANCE MONITORING SOFTWARE HELPS NBFCs IN MITIGATING THE RISK?

-

Managing Regulatory Documents

- Enables multiple departments to create repository of regulatory documents at single platform

- Ensures confidentiality as document access is only with authorized personnel

- Compliance Monitoring

- Periodic monitoring of compliance obligations with advanced reminders for due/overdue compliances.

- Identify potential compliance gaps

- Documents Verification

- Doer and Checker system to increase accuracy in submissions.

- Multiple check system.

- Data Reporting & Analytics

- Various kind of compliance report which can help an NBFC to analyze compliances.

- Helps management to understand user patterns and compliance success.

- Reporting and analytics to pinpoint non-compliant sources

- Data Security

- Multi factor authentication for login to enhance security

- Accounts may be temporarily disabled afer repeated wrong attempts for added security

KEY COMPLIANCE REGULATIONS FOR NBFC’s

| 1 | Master Direction – Reserve Bank of India (Non-Banking Financial Company- Scale Based Regulation) Directions, 2023 |

| 2 | Master Direction – Reserve Bank of India (Filing of Supervisory Returns) Directions, 2024 |

| 3 | Master Direction – Information Technology Framework for the NBFC Sector (Base Layer Applicability) |

| 4 | Master Direction on Information Technology Governance, Risk, Controls and Assurance Practices |

| 5 | Master Direction – Non-Banking Financial Companies Auditor’s Report (Reserve Bank) Directions, 2016 |

| 6 | Master Direction – Know Your Customer (KYC) Direction, 2016 |

| 7 | Master Direction – Reserve Bank of India (Transfer of Loan Exposures) Directions, 2021 |

| 8 | Master Direction – Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021 |

| 9 | Master Direction – Reserve Bank of India (Regulatory Framework for Microfinance Loans) Directions, 2022 |

| 10 | Master Direction – Monitoring of Frauds in NBFCs (Reserve Bank) Directions, 2016 |

| 11 | Master Direction- Internal Ombudsman for Regulated Entities |

| 12 | Master Direction – Credit Card and Debit Card – Issuance and Conduct Directions, 2022, |

| 13 | Master Direction-Reserve Bank of India (Commercial Paper and Non-Convertible Debentures of original or initial maturity upto one year) Directions, 2024 |

| 14 | NBFC-P2P – Master Directions – Non Banking Financial Company – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017 |

| 15 | NBFC-AA – Master Direction- Non Banking Financial Company – Account Aggregator (Reserve Bank) Directions, 2016 |

| 16 | CIC – Master Direction – Core Investment Companies (Reserve Bank) Directions, 2016 |

| 17 | SPD – Master Direction – Standalone Primary Dealers (Reserve Bank) Directions, 2016 |

| 18 | Master Directions on Prepaid Payment Instruments (PPIs) |

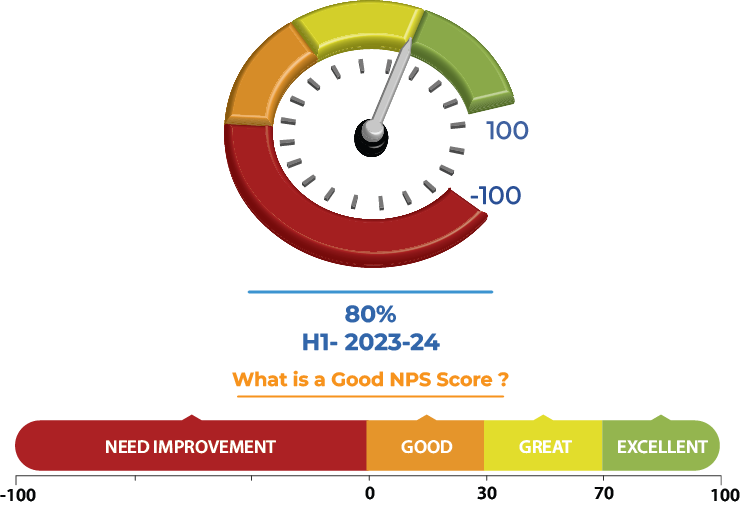

H1-2023-24

Net Promoter’s Score (NPS)

Rate your overall experience working on the GCMS ?