Companies Act, 2013

Procedure for Incorporation of Producer Company

Introduction:

Company refers to a legal entity construed by a class of individuals to conduct business—commercial or industrial and erstwhile becomes a distinct entity separate from its promoters, members, directors, workforce, etc. upon being legally incorporated under the Companies Act, 2013 or any previous Company Law. There are numerous forms to choose from for incorporating a Company such as One Person Company, Private Company, Public Company, Small Company, Section 8 Company, Nidhi Company, Producer Company each of which has its respective pros and cons.

Producer Company: Producer Company is a body corporate formed by Producers who are persons engaged in any activity or connected with or relatable to any primary produce i.e., produce of farmers arising from agriculture including animal husbandry, horticulture, floriculture, pisciculture, viticulture, forestry, forest products, re-vegetation, bee keeping and farming plantation products and also, include the produce of persons engaged in handloom, handicraft and other cottage industries, by-products of such products, and products arising out of ancillary industries.

Applicable Provisions:

- Section 378C and 378D of Companies Act, 2013

Mandatory Requirements:

- Any one of the following combinations can only form a Producer Company:

- any 10 or more individuals each of them being a producer or

- any 2 or more Producer Institutions or

- combination of 10 or more individuals and Producer Institution.

- Minimum of 5 and maximum 15 directors in a Producer Company.

- The chosen name should co-relate with the objects to be undertaken by the company and the words “Producer Company” shall be added at the end of its name.

- The company shall ensure to own a registered office, within 30 days of its incorporation and at all times thereafter, where all the communications and notices addressed to it can be received and acknowledged.

Procedure:

-

Registration on the MCA Portal:

The first step to avail incorporation services through SPICe+ Web form is creating a login account in case of new users as under:- Click on the ‘Sign In/Sign Up’ option on the top right-hand side of the homepage then click on register button

- Next select User Category as Business User* and then Select the User Role fill the required login details and click the Create My Account button

- An OTP will be generated to user’s Mobile number, and after feeding the OTP a registration confirmation shall be sent to the email address of user.

- Registered User having access to all the basic e-services of MCA and has a password-based login

- Business User having access to certain specific services in addition to all the basic e-services of MCA available to the registered users and has a Digital Signature Certificate-based login. This category of users covers practicing members of ICSI/ICAI/ICWAI and individuals associated with companies such as Directors, Managers, secretaries, etc

-

Fill Part–A of the SPICe+ Form:

- The next step is to reserve the name of the proposed company by filling in the information as under in Part-A of the SPICe+ form:

- Type, class, category, and sub-category of Company (as per Annexure A)

- Main Division of Industrial Activity of the Company and description of the main division (as per Annexure B)

- Proposed names (Maximum 02 names) for the prospective company ensuring that the proposed names do not contain any word prohibited under the provisions of the Companies Act, 2013 and the rules made thereunder

- Upon filling in all the information as stated above, the applicant shall submit the Part-A of the SPICe+ form choosing either to apply for name reservation separately and pay a fee of Rs. 1000/- (Rupees One Thousand Only) or proceed with the company incorporation (Note: Direct incorporation option should be chosen only if the applicant is sure about the availability of its proposed name).

- It is recommendable to attach objectives in detail so that there will be no ambiguity in the mind of the approver while approving the name of the proposed company and No Objection Certificates (NOCs) [in case approval from any Sectoral Regulator is required and had been applied for the proposed name] is mandatory to be attached along with Part A of SPICe+ form.

- Only one file is allowed to be uploaded as an attachment of a maximum 10MB size for Part-A of SPICe+ form.

- The chosen name for the entity should not:

- resemble the name of any existing company or

- be undesirable or include the name of registered trade mark or a trade mark which is subject of an application for registration, unless the consent of the owner or applicant for registration, of the trade mark, as the case may be to this effect has been obtained

- have such words or expressions that require prior approval of Central Government.

- The next step is to reserve the name of the proposed company by filling in the information as under in Part-A of the SPICe+ form:

-

Fill Part-B of the SPICe+ Form:

- The next step in the incorporation procedure is to Access Service Request Number(SRN) dashboard by clicking on the Mini Dashboard tab to fill the information in Part-B of the SPICe+ form as under:

- Details of company’s capital structure

- Details of registered office address

- Details of the first subscribers and directors

- Particulars of Payment of Stamp Duty

- Details about jurisdiction for obtaining Permanent Account Number/Tax Collection Account Number

- The application for incorporation of a company shall be supported with the following attachments:

- Memorandum of Association

- Articles of Association

- Utility Bill of registered office (not older than 02 months

- Declaration by the first director(s) and subscriber(s)

- Identity and Residential Proof of all the Subscribers (such as Permanent Account Number, Aadhaar Card, Bank Statement, Voter ID, Driving License, Passport)

- Identity and Residential Proof of all Applicant (such as Permanent Account Number, Aadhaar Card, Bank Statement, Voter ID, Driving License, Passport)

- Identity and Residential Proof of all Applicant (such as Permanent Account Number, Aadhaar Card, Bank Statement, Voter ID, Driving License, Passport)

- Rent Agreement duly notarized and NOC from the Owner of the property (in case of rented property)

- Form DIR 2 (consent from all the Directors to act in such capacity)

- Optional Attachments (if any)

- After attaching all the necessary documents, the applicant shall submit the Part-B of the SPICe+ form.

Note:- First directors not having Director Identification Number or Subscribers having Permanent Account Number shall associate their Digital Signature Certificate under ‘authorized representative’ by providing their Permanent Account Number. Once Director Identification Number is allocated for first directors’ post-approval of SPICe+, Digital Signature Certificate may be updated against Director Identification Number by using the ‘Update Digital Signature Certificate’ service

- In case a body corporate is one of the subscribers/promoters, then the Digital Signature Certificate of an authorized representative be affixed along with the form.

- The next step in the incorporation procedure is to Access Service Request Number(SRN) dashboard by clicking on the Mini Dashboard tab to fill the information in Part-B of the SPICe+ form as under:

-

Filing Other Relevant Forms (AOA, MOA, AGILE-PRO and INC-9):

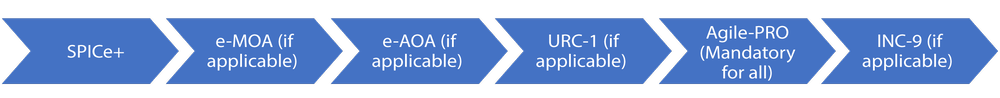

- The next step in the incorporation procedure is to submit the following forms:

- Fill the details in the physical form of Article of Association

- Fill the details in the physical form Memorandum of Association

- Fill the details in the e-form AGILE-PRO for obtaining Goods and Services Tax Identification Number/ Employees’ Provident Fund Organization/ Employee’s State Insurance Corporation /Profession Tax Registration and Opening of Bank A/c (as may be applicable)

- Declaration by all Subscribers and first Directors in INC-9 shall be auto-generated in pdf format and would have to be submitted only in electronic form in all cases, except where:

- Total number of subscribers and/or directors is greater than twenty and/or

- Any such subscribers and/or directors have neither Director Identification Number nor Permanent Account Number.

- Registration for Employees’ Provident Fund Organization and Employee’s State Insurance Corporation (if applicable for the applicant) is mandatory for all new companies incorporated w.e.f 23rd February 2020 and no separate Employees’ Provident Fund Organization & Employee’s State Insurance Corporation registration nos. will be issued by the respective agencies. All new companies incorporated through SPICe+ web service (w.e.f 23rd February 2020) would also be mandatorily required to apply for opening the company’s Bank account through the AGILE-PRO linked web form.

- For main Objects (Field 3(a)), character limit is 20,000 and for furtherance of objects (Field 3(b)), it is 1,00, 000 characters.

- Companies getting incorporated through SPICe+ with an Authorized Capital up to INR 15,00,000 would continue to enjoy ‘Zero Filing Fee’ concession. Such companies will be levied with only stamp duty fees as may be applicable on state-to-state basis.

- The next step in the incorporation procedure is to submit the following forms:

-

Upload the Documents for Final Submission:

- After the completion of filling all the requisite information, the applicant shall convert all the linked e-forms i.e., PART-B of SPICe+ form, AGILE-PRO, and INC-9 into PDF format and affix Digital Signatures on them for uploading in the sequence provided as under:

- After the payment of applicable incorporation fees (as per Annexure D), the incorporation procedure gets completed.

- Any further changes/modifications to SPICe+ (even after generating pdf and affixing Digital Signature Certificate), can be made up to five times by editing the same web form application which has been saved, generating the updated pdf affixing Digital Signature Certificates and uploading the same.

- The Incorporation Certificate may be received within 3-4 working days of successful submission subject to Central Registration Centre-Registrar of Company approval.

- Upon registration, a Producer Company shall become a body corporate as if it is a private limited company without any limit to the number of Members thereof, and shall not, under any circumstance, become or be deemed to become a public limited company under this Act. (Section 378C(5) of the Companies Act, 2013)

- After the completion of filling all the requisite information, the applicant shall convert all the linked e-forms i.e., PART-B of SPICe+ form, AGILE-PRO, and INC-9 into PDF format and affix Digital Signatures on them for uploading in the sequence provided as under:

-

Post Incorporation Compliances:

- In case the registered address is not provided in SPICe+, then e-Form INC-22 is required to be filed within thirty days of its incorporation, for intimating the registered office address to the concerned authority.

- . The company shall maintain and preserve at its registered office copies of all documents and information as originally filed whilst incorporation process till its dissolution under this Act.

- Every company that conducts online business or otherwise shall disclose/publish its name, registered office address, Corporate Identification Number, telephone number, fax number, email and name of the contact person in case of any queries or grievances.

- . A statement shall be filed within 180 days of incorporating the company with the Registrar in Form INC 20A along with the charges as might be agreed by a director that each subscriber to the memorandum has share value consented to be taken by them on the date of creation of such an assertion to obtain certificate of commencement of business.

Key Points in respect of Producer Companies:

- Every Producer Company shall primarily deal with the produce of its active Members for carrying out any of the objects as specified in the Act.

- Producer Company so formed shall have the liability of its Members limited by the Memorandum to the amount, if any, unpaid on the shares respectively held by them and be termed as a Company limited by shares.

- Producer Company may reimburse to its promoters all the other direct costs associated with the promotion and registration of the company including registration, legal fees, printing of a Memorandum and Articles subject to the approval of the Members at its first general meeting for such payment.

- Restrictions w.r.t membership:

- Any person, who has any business interest which is in conflict with business of the Producer Company, shall be abstained from becoming a Member of such Company

- A Member, who acquires any business interest which is in conflict with the business of the Producer Company, shall cease to be a Member of that Company and be removed as a Member in accordance with the articles.

- All the limitations, restrictions and provisions of this Act, applicable to a private company, shall, as far as may be, apply to a Producer Company, as if it is a private limited company under this Act in so far as they are not in conflict with the provisions of Chapter XXIA (Producer Companies).

Tell us how helpful was this post?

Our Solutions

Related Procedures

- Procedure for Transfer of Shares to IEPF

- Procedure for Making Calls on Shares

- Procedure for Claiming Unpaid Amounts and Shares from IEPF

- Procedure for Change in Name of the Company

- Procedure for Conducting Extraordinary General Meeting (EGM)

- Procedure for Appointment of Existing Director as Managing Director or Whole-time Director

- Procedure for Appointment of First Auditor in a Government Company

- Procedure for Conversion of Any Existing Company to Section 8 Company

- Procedure for Issue of Debentures

- Procedure for Registration or Creation or Modification of Charges